In the world of Finance, audit opinion plays an important role in assessing the credibility of a company's financial statements.

However, under certain conditions, auditor. may give an opinion does not express an opinion on the audit conducted

When this happens, it means that the auditor does not give an opinion on the audited financial statements.

So, what is an opinion not expressing an opinion and what is the basis for giving such an opinion? Find the answer in the following article!

Definition Of Opinion Not Expressing An Opinion

Unrepresented opinion is a statement issued by the auditor stating that the auditor did not provide an opinion regarding the client's financial statements.

If the client allows the auditor to complete the audit process by correcting the underlying nonconformities, then the auditor may be able to provide another audit opinion.

Until the auditor issues a substitute opinion, the statement not expressing this opinion remains valid.

Opinion does not express an opinion is also called disclaimer of opinion.

Opinion Base Does Not Express An Opinion

Opinion base not expressing an opinion is when the auditor cannot obtain sufficient evidence to give an opinion on the fairness of the financial statements.

This happens due to the presence of significant restrictions in the scope of the audit, such as the inability to access important data necessary for the examination.

As a result, the auditor cannot ascertain whether there are material errors in the financial statements that could affect the overall information presented.

Giving this opinion does not only mean that the auditor does not give an opinion, but rather the recognition that they cannot conduct a thorough audit.

Thus, it is not possible for auditors to provide guarantees related to the fairness of financial statements.

Opinion disclaimer it is often viewed very negatively, as it indicates a serious problem in the company's financial transparency.

Examples Of Opinions Not Expressing Opinions

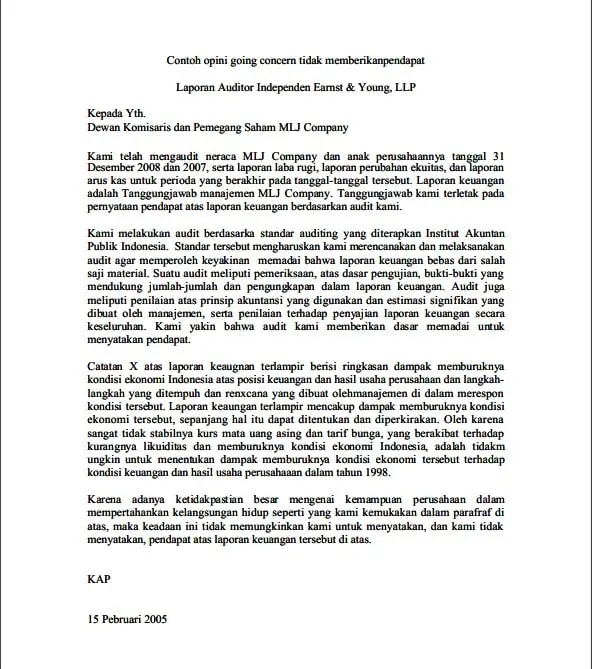

The figure is an example of an opinion not expressing an opinion on an independent audit.

In such cases, the company does not perform physical calculations of inventories so that auditors cannot verify the value of inventories and fixed assets.

The inability of auditors to ensure the accuracy of such data makes them unable to give an opinion, because the scope of the audit is very limited.

This opinion indicates the existence of significant limitations in the conduct of audits that may cast doubt on the fairness of the company's financial statements.

Here is another example of an opinion not expressing an opinion for a special case going concern.

The auditor's report stated that it did not provide an opinion on the company's financial statements because the issue going concern economic conditions.

Issues going concern it comes when auditors see serious signs that threaten the company's business continuity.

In this particular case, the auditor may choose not to give an opinion due to the high uncertainty regarding the company's ability to survive.

Implications of not expressing opinions for business

Opinion not expressing an opinion is not just an ordinary audit opinion but has serious implications for the company including.

1. Loss Of Trust Stakeholders

When auditors give this opinion, it can lead to loss of confidence from various stakeholders such as investors, creditors, and regulators.

This opinion indicates that the auditor cannot provide assurance on the fairness of the financial statements so that outsiders doubt the stability and credibility of the entity.

2. Impact On Reputation

Companies that accept opinions do not express opinions may experience a decrease in reputation in the market.

For public companies, these opinions can influence stock prices and investment decisions.

This condition occurs because investors tend to avoid entities that cannot provide clear and verified financial statements.

3. The Need For Remedial Measures

In some cases, not expressing an opinion can signal a serious problem that needs to be addressed immediately.

Companies should take steps to improve internal control, financial reporting systems, and accessibility to information needed by auditors.

4. Influence on the decision-making process

This opinion can also influence managerial and strategic decisions within the entity.

Decision makers may need to review budgets, projections, or investment plans based on the fact that their financial statements have not been adequately audited.

Tips To Avoid Opinions Not Expressing Opinions

To avoid unreasonable audit opinions, companies need to ensure that important aspects have been carried out, namely:

1. Implement effective Internal controls

Effectiveness internal control not only ensure the financial statements produced are accurate.

However, internal control must produce also a solid system for managing financial risks and liabilities with high transparency.

2. Building a strong financial policy

Developing a clear financial policy and adhering to Generally Accepted Accounting Principles is a good first step.

This policy simplifies the reporting process and reduces the potential for errors that could affect the auditor's opinion.

3. Do Review Periodically

Conducting regular reviews of financial policies and controls by the internal audit team helps the company identify potential problems early.

This allows for improvements before an external audit is carried out thereby reducing the risk of problems that could harm the audit opinion.

4. Use Software As A Solution

Using software audit management can improve transparency and accountability in financial reporting.

This software audit management helps the efficiency of the audit process by providing integrated best practices that make it easier for auditors to assess the readiness of the company's financial statements.

Conclusion

Opinions do not express opinions given by auditors when they are unable to obtain sufficient evidence to assess the fairness of a company's financial statements.

This can result from significant limitations in the scope of the audit such as the inability to access critical data.

To avoid opinions do not express opinions, Audithink's Comprehensive Features become a business solution by providing features for systematic audit planning, monitoring real-time, and automatic reports.

These features ensure easy and complete data access, so that auditors can obtain sufficient evidence to give an opinion

Contact us now for more offers!