Audit opinion is a key factor in maintaining stakeholder confidence in the company

When auditors give unreasonable opinions, it becomes a serious warning that the company's financial statements cannot be trusted.

This situation can have a severe impact on the company, such as lowering its reputation to affect access to funding.

So, what is an unnatural opinion? How can companies avoid this? Check out the full explanation below!

What is unnatural opinion?

An improper opinion is a statement from the auditor that indicates that the company's financial statements are presented incorrectly, contain inaccuracies, and do not reflect the actual conditions.

Auditors generally give this opinion when the financial statements deviate significantly from the principles accounting generally applicable.

Also called the term. “adverse opinion“ , this opinion is not given arbitrarily by the auditor.

This opinion is given after the auditors conduct an in-depth examination of the financial statements and gather sufficient evidence to support their findings.

This opinion can be given by both internal and independent auditors.

Examples Of Unnatural Opinions

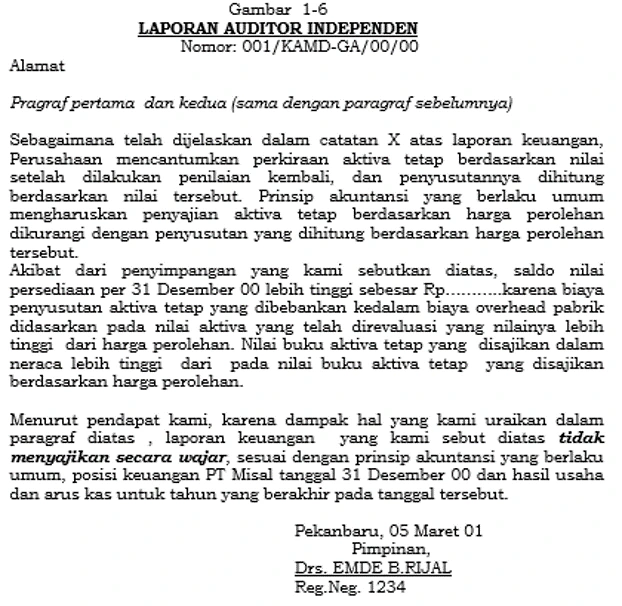

In the results of the audit, an opinion was not reasonably given because the company presented fixed assets based on revaluation value, not acquisition price according to General Accounting Principles.

In addition, depreciation charges were not properly recognized, causing inventory balances as of December 31 to be higher than they should have been.

As a result, the financial statements do not reflect a reasonable and accurate financial position, so the auditor concludes that the reports are distorted.

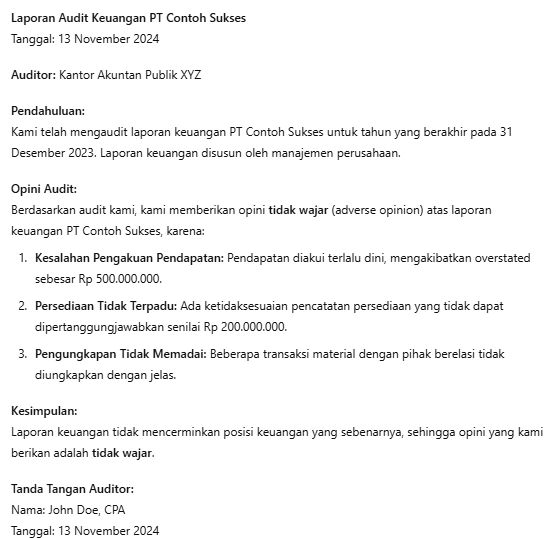

Here is an example of an unreasonable opinion in another audit.

Causes Of Unnatural Opinions

The provision of this opinion by the auditor is certainly not for unclear reasons, but because of the following factors.

- Significant Accounting Errors: Errors in the recording or recognition of transactions that have a major impact on the financial statements. For example: incorrectly record income or expenses so that the results of the report do not reflect the actual conditions.

- Non-compliance with Accounting Standards: The use of accounting methods that are not in accordance with applicable accounting standards (for example, IFRS or PSAK). The discrepancy causes the presentation of financial statements is not in accordance with standard rules.

- Audit Scope Restrictions: The auditors are not given full access to the required information, or there are limitations in the audit procedures so that they cannot carry out adequate verification or testing of a part of the financial statements.

- Non-compliance with the rules: The company may not comply with certain regulations that have a significant impact on the financial statements, such as taxation, trade law, or industry regulations

- Cheating or Fraud: There are indications of fraud or deliberate manipulation of financial data by management or employees.For example: overstating assets or understating liabilities resulting in distortions in financial statements.

The Impact Of Unnatural Opinions On Business

Not only related to stakeholder trust, this opinion has several negative impacts on business including .

1. Investor Confidence Is Declining

When the auditor expresses an unreasonable opinion, this indicates that there are financial aspects that are considered not in accordance with accounting standards.

Investors may think there are serious problems in financial management, which could cause them to withdraw investments or hesitate to increase funds.

2. Company Reputation Affected

This opinion can have an impact on the reputation of the company, especially in the eyes of potential partners or customers. Companies with a dubious reputation may find it more difficult to establish business partnerships.

This tarnished reputation can make partners or potential customers choose to cooperate with more reliable competitors.

3. Limited access to financing

Unreasonable opinions can make it difficult for a company to get a loan or financing.

Banks or financial institutions see financial statements as one indicator of business health.

Banks may offer stricter loan terms or even refuse financing applications altogether.

4. Difficulties in the acquisition process or Merger

For companies in the process merger or acquisition, unreasonable audit opinion can be a big obstacle.

Potential buyers will conduct more rigorous investigations that could slow or cancel the deal.

5. Possibility Of Legal Cases

If the unnatural opinion is caused by errors or deliberate financial irregularities, the company could face legal problems.

This is because such practices may violate applicable financial and tax laws.

How To Avoid Unreasonable Opinions

- Ensure Accurate Accounting Records

Avoid significant accounting errors by making proper records of income, expenses, and assets so that the financial statements reflect the actual conditions. - Follow the applicable accounting standards

Apply accounting methods that comply with applicable accounting standards, such as IFRS or PSAK, to ensure financial statements are presented correctly. - Provide full access to auditors

Ensure auditors have full access to all information and documents needed to verify financial data thoroughly. - Comply with relevant rules and regulations

Always comply with applicable tax laws, trade laws and industry regulations to avoid violations that have an impact on financial statements. - Prevent fraud and data manipulation

Conduct strict internal supervision to prevent fraud or manipulation of financial data that can damage confidence in financial statements. - Correct Errors As Soon As Possible

If errors are found in the financial statements, immediately make corrections before the report is audited to avoid the adverse effects of unreasonable opinions. - Conduct Regular Internal Audit

Do it internal audit routinely to ensure compliance with accounting standards and financial data integrity before being audited by external auditors.

By taking these steps, the company can reduce the risk of receiving unreasonable opinions and maintain the reputation and trust of stakeholders.

Conclusion

Unreasonable opinions on audits indicate significant irregularities in financial statements that can undermine stakeholder confidence and negatively impact the company's reputation.

To avoid this opinion, the company needs to ensure compliance with accounting standards, provide full access to auditors, as well as conduct accurate financial records.

Preventive measures such as regular internal audits and monitoring for fraud can help maintain the integrity of financial statements and avoid unreasonable opinions.

In addition, use software Audit such as Audithink's Comprehensive Features who are able to identify and analyze potential risks in financial statements automatically.

This software it can also monitor the accuracy of the implementation of accounting standards, provide recommendations for improvements, as well as generate faster and more accurate audit reports.

Contact us now!