The accuracy of financial statements is an important foundation for a business in making the right decisions.

To ensure this, an unqualified opinion is the expected outcome of the audit process.

In this article, we will discuss what an unqualified opinion is and the steps to achieve it!

Understanding Of Unqualified Opinion

An unqualified opinion is a statement by an independent auditor that the financial statements of a business have been reasonably presented in all material respects.

This means that important elements such as the company's financial condition, cash flow, and results of operations are in accordance with applicable accounting principles.

The compliance standards referred to in this opinion may be Financial Accounting Standards (SAK) in Indonesia or Generally Accepted Accounting Principles (GAAP) in other countries.

This opinion is the highest level in audit opinion because it confirms the absence of material errors or discrepancies in the company's financial statements.

This opinion is also called unqualified opinion.

Conditions For Obtaining An Unqualified Opinion

This opinion can be given by the auditor if the following three conditions are met

- There are no restrictions on the scope of the examination. If there are restrictions, they are not material and can be overcome by alternative procedures.

- Auditors not subjected to pressure from the other party during the inspection process.

- No offense against accounting standards. If there is a violation, then the violation is not of a material nature.

Strategies For Getting Unqualified Opinions

To get the success of the audit results, here is a strategy that you can apply.

- Transparent and accurate financial system management: Management includes recording every transaction in a timely and transparent manner will increase auditor confidence in the data provided.

- Compliance with applicable accounting standards: Following the latest accounting standards, will reduce the risk of non-conformity of financial statements.

- Improvement Of Internal Audit Procedures: Internal audit plays an important role in identifying and correcting errors before external audits are conducted.

- Consistent and error-free reporting of Material: To obtain a WTP opinion, financial statements must be consistent and free from material errors.

- Compliance with tax regulations: Errors in tax reporting or tax arrears can lead to an unreasonable opinion of the auditor. Therefore, the company must comply with all applicable tax provisions.

- Support external auditors with information needed: By providing complete and open data and facilitating the audit process, the company will make it easier for auditors to make their assessments.

- Effective risk management: Risk identification and proper management will minimize the potential for violations in the financial statements so that all transactions are in accordance with applicable regulations.

- Accounting Education and training for Finance staff: Equipping financial staff with the latest accounting training really helps maintain the quality of financial statements.

Examples Of Unqualified Opinion Audit Reports

Here are some references to the auditor's opinion with unqualified type.

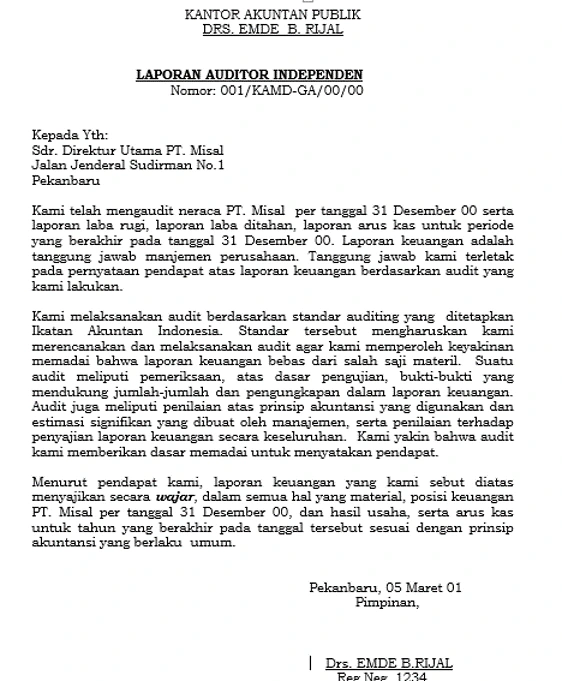

Example 1

The independent auditor's report is published by a public accounting firm.

Auditors certify that they have audited the company's financial statements, which consist of the balance sheet, income statement, retained earnings, and cash flows.

Based on audit results, auditor. provide unqualified opinion, which means that the financial statements are stated to be reasonable in all material respects.

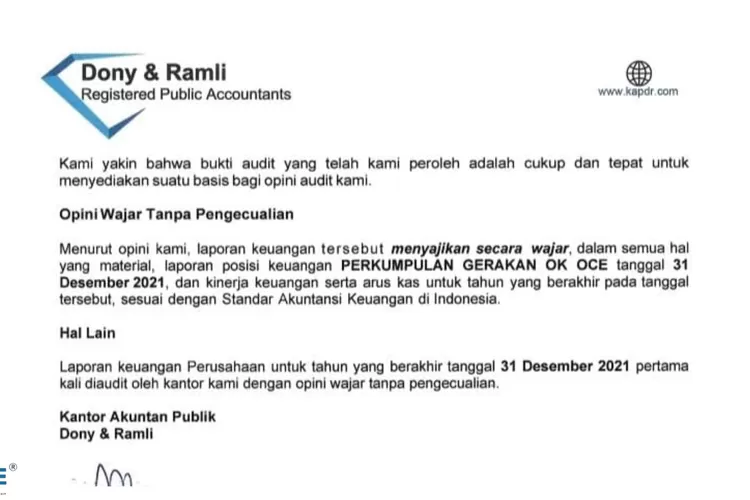

Example 2

This report is made by a public accounting firm.

The Auditor certifies that the financial statements reasonably present the financial position and financial performance for the period.

The audit results stated that the financial statements in accordance with Financial Accounting Standards in Indonesia.

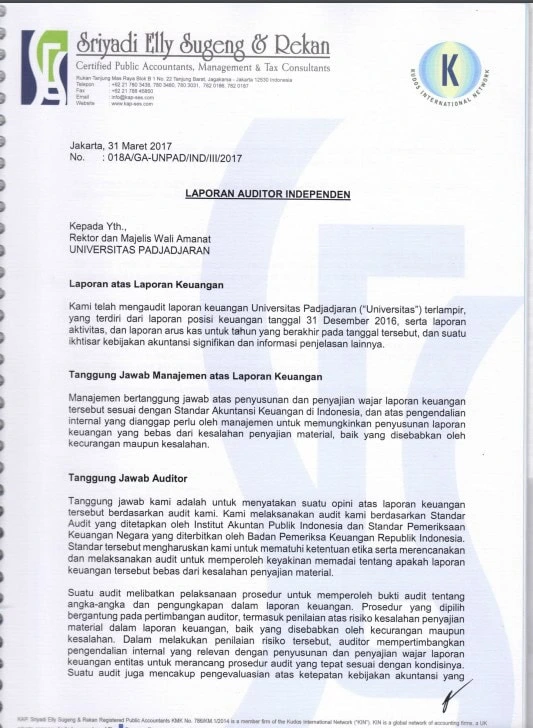

Example 3

This independent auditor's report comes from a public accounting firm for a university.

The financial statements of the University are asked by the auditor that they have been prepared in accordance with Financial Accounting Standards.

This report also includes the responsibilities of management and auditors in the process of preparing and auditing financial statements.

These three reports provide unqualified opinions that indicate that the financial statements of each company or agency are in accordance with applicable accounting standards and are free from material misstatements.

Does this opinion reflect the company's Financial Performance?

Unqualified opinion (WTP) does not directly describe the company's financial performance.

When the auditor gives this opinion, it is not a reflection of whether the client's financial condition but only an affirmation that the financial statements have been prepared in accordance with applicable accounting principles.

The Auditor may also give an opinion going concern although accompanied by reasonable opinion without exception if there are indications.

Opinion going concern inform of the potential inability of the business to continue to operate properly.

Factors that trigger opinions going concern various, For example, due to a significant decline in financial performance or failure of the company to meet its credit obligations.

Unqualified opinion with additional explanations

An unqualified opinion with an additional paragraph is given when the financial statements are free from material misstatements but there is important information that needs to be explained further.

The explanation serves to provide a better understanding of the client.

In this situation, the auditor adds an explanatory paragraph after the main opinion to draw the user's attention to certain significant points.

For example, an explanation of financial material uncertainties related to certain conditions, the impact of major disasters experienced by the company, transactions with related parties, or issues going concern.

Conclusion

Unqualified opinion (WTP) is an auditor's statement stating that the company's financial statements have been prepared reasonably and in accordance with applicable accounting standards.

This opinion is the highest audit opinion is not a direct reflection of the company's financial condition, but rather a guarantee that the report is prepared correctly and accurately.

This opinion may also include additional explanatory paragraphs if the auditor feels that there is important information that must be considered.

This opinion can be achieved thanks to the support of internal audit software such as Audithink's Comprehensive Features which improves the quality and accuracy of the audit process.

With real-time automation and compliance monitoring, an audit software we ensure that any potential deviations or material errors can be detected and corrected.

Contact us now!