Auditor's opinion in the process of auditing financial statements may vary. One type of opinion given is a reasonable opinion with exceptions.

This opinion indicates that the company's financial statements are generally considered reasonable, but there are some deviations or problems in certain aspects.

To better understand the implications, let's explore more about fair opinions with exceptions and how they affect business.

Definition of reasonable opinion with exceptions

Fair opinion with exceptions is a type of audit opinion that states that the financial statements reflect the financial condition of the company, but there are some parts that are not appropriate standard.

In contrast to the unqualified opinion that indicates full feasibility, this opinion indicates a higher level of uncertainty and risk.

However, the nonconformity is not significant enough to change the entire content of the fair opinion audit report with exceptions.

In the excluded aspects, the auditor only provides special notes, but the financial statements can still be used as a basis for decision making.

Reasonable opinions with exceptions are considered lighter than unreasonable opinions or opinions that do not provide opinions.

However, this opinion still needs to be an important concern for stakeholders

Examples of reasonable opinions with exceptions

To give you a further idea, here we present some examples related to these opinions.

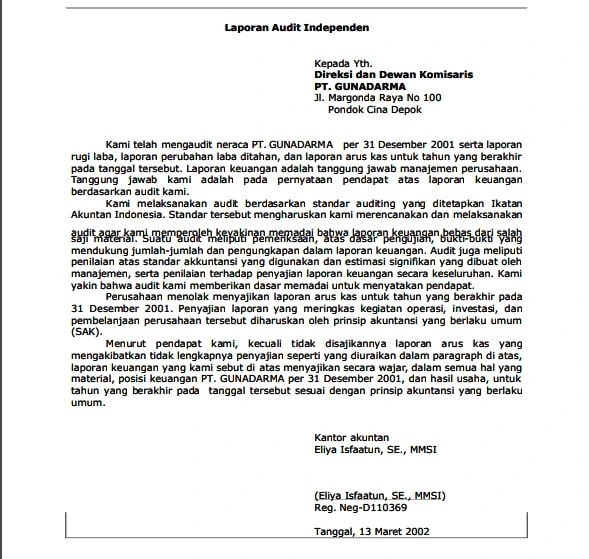

Examples of reasonable opinions with exception 1

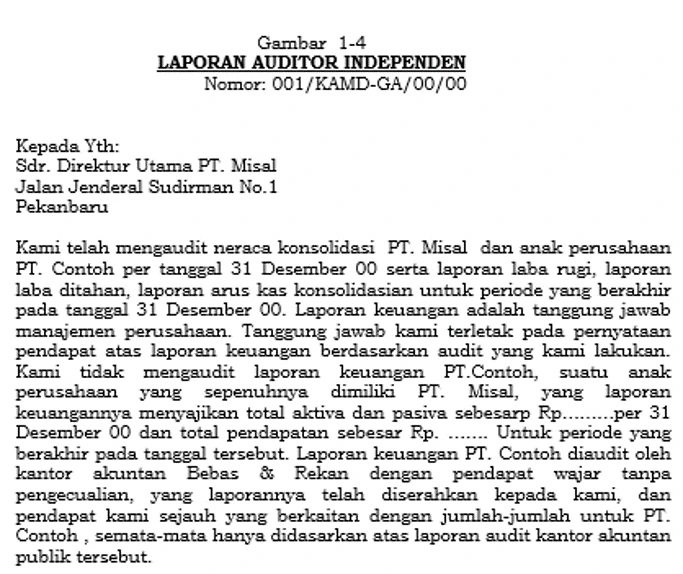

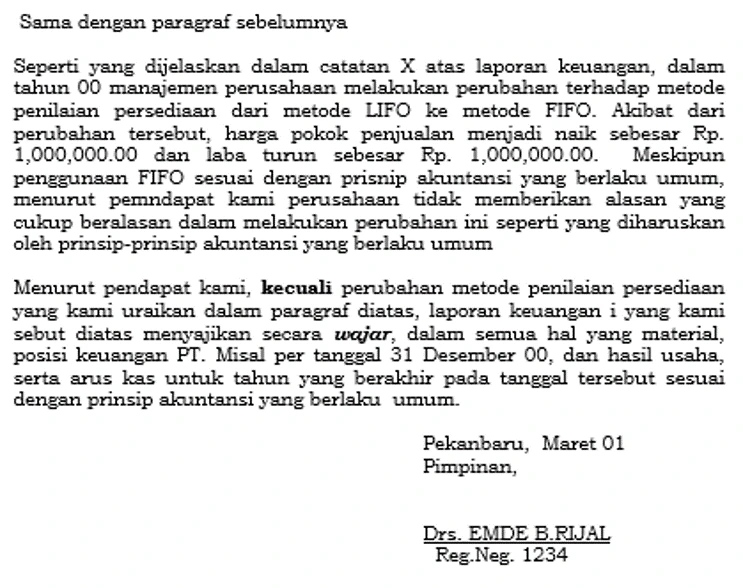

Examples of reasonable opinions with 2 exceptions

The basis for giving reasonable opinions with exceptions

Audit opinion is not given arbitrarily, but based on certain parameters, namely:

1. Audit Scope Restrictions

The restriction in question is the unavailability of access or information necessary to conduct a thorough examination.

When relevant documents or records are not provided, the auditor can only evaluate a portion of the financial statements.

If the unreached area is limited to a certain part and does not have a significant impact on the overall financial statements, the auditor will issue a fair opinion with exceptions.

2. Non-compliance with applicable accounting principles

The Auditor will give a reasonable opinion with the exception if the company does not fully follow the generally accepted accounting principles in some parts of the financial statements.

For example, a company may record Revenue by a method different from the established standard.

The Auditor may tolerate this discrepancy as long as the impact is not significant to the overall report.

3. Insufficient or inadequate disclosure

In order to accurately understand and assess financial statements, adequate information is required.

If the disclosure is lacking but does not change the overall interpretation of the report, a reasonable opinion with exceptions may still be given.

An example is when a company fails to include details of some particular transaction.

Implication of reasonable opinion with exceptions

Giving reasonable opinions with exceptions is not as heavy as unreasonable opinions.

However, this opinion is a warning that there are certain aspects that need to be considered by stakeholders. This opinion has several impacts on various aspects, including:

1. Stakeholder Trust

Stakeholders, such as business partners and investors, may question the quality of a company's financial reporting and management.

Imperfections in the report can lower their confidence in financial management and internal oversight.

2. Relationship with creditors and investors

Reasonable opinions with exceptions can make creditors and investors more cautious of the company.

Creditors may raise interest rates or request additional collateral. Investors may also notice additional risks.

To overcome this, the company can provide a transparent explanation and take corrective steps.

3. Improvements in Internal control

One of the main causes of this opinion is the weakness in internal control.

This opinion can encourage management to improve the control system, which not only reduces future risk but also improves efficiency and long-term accountability.

4. Company Reputation

In addition to influencing stakeholders, this opinion can also damage the company's reputation in the public eye regarding the quality of its financial statements.

Therefore, the company must respond proactively to this report and immediately take corrective steps to resolve the issue.

So, what actions should be taken to evaluate the existence of reasonable opinions with exceptions?

Actions the company can take

1. Improving The Quality Of Internal Control System

Effective internal control can reduce errors or irregularities in financial statements.

To achieve this, control must be guided by applicable standards and regulations so that the reports produced are accurate and reliable.

2. Ensure transparency of Information and disclosure

During the audit process, companies must provide information honestly and openly, without hiding relevant data or facts.

The provision of sufficient detailed information will help to understand and assess the financial position and performance of the company clearly.

3. Evaluating The Financial Reporting Process

An efficient and complete reporting process will make it easier for auditors to conduct checks.

Companies can periodically evaluate their reporting processes and improve them if necessary.

4. Using Audit Software

To avoid reasonable opinions with exceptions, software audit it can be used to improve transparency, accuracy, and efficiency in the audit process.

With the existence of audit software, companies can get several benefits including.

- Automation and accurate recording: With the automation feature, manual errors during recording can be minimized, so that the data presented is more accurate.

- Continuous Monitoring: Audit Software is able to run continuous monitoring on the company's transactions and activities so as to assist in the detection of non-conformities.

- In-depth risk analysis: Audit Software allows companies to conduct in-depth risk analysis of various aspects.

- Tracking documentation and Audit evidence: With audit software, all documents and audit evidence are stored in one platform, making it easier for auditors to verify information.

Conclusion

Audit report reasonable opinion with exceptions is the result of an audit that states the company's financial statements are generally reasonable, but there are some parts that are not fully in accordance with the standard.

While such discrepancies are not significant enough to change the overall report, these opinions may affect stakeholder confidence, relationships with creditors and investors, and the company's reputation.

To overcome this opinion, companies need to improve internal controls, maintain transparency, improve financial reporting processes regularly, and use audit software.

Trusted by companies in various industries, use Audithink to help audit management processes in your company's internal systems.

Our Software will enhance audit effectiveness with advanced features such as risk assessment and automated reporting.

Contact we are now!